Why Inflation Matters & How Asset Allocation is Your Best Tool

"Make the best use of what is in your power, and take the rest as it happens.” - Epictetus

Inflation in the U.S has risen at the fastest pace in over four decades. The consumer-price-index (CPI) rose 8.5% in March 2022 compared to the same month in 2021 – the highest year over year increase since 1982. Even the core price index, which excludes the notably volatile categories of food and energy, has risen at the fastest rate since 1982.

With inflation at these elevated levels, it has become a popular topic of discussion for economists, investors, and consumers alike. Some may debate the cause, attributing it to supply-chain disruptions, the shrinking labor market, fiscal policy, and/or a combination of other factors. The nature of inflation, whether it is transitory or not, has perhaps been even more controversial as the Fed has shifted their views in recent months.

But just as we believe that market timing is not a worthwhile endeavor, we think it is best not to spend much bandwidth speculating on the nature or trajectory of inflation. Instead, we strive to take a page out of Greek philosopher, Epictetus’, Dichotomy of Control. Rooted in Stoic philosophy, Dichotomy of Control, provides a framework for problem solving that separates problems into two categories: things we can control and things that we cannot. Then, it encourages us to focus our time and energy on those things that we determine to be within our control.

You may have seen this more modern, and simplified, interpretation of Epictetus’ philosophy below. Often used as an important reminder for those facing life’s personal and professional challenges, the Venn diagram also serves as a useful reminder for durable investment processes.

Source: Carl Richards/ Behavior Gap

Source: Carl Richards/ Behavior Gap

So let’s apply this framework to our issue at hand: inflation. We must determine if inflation matters, and which elements we can and cannot control as it relates to our portfolios.

Does inflation matter? Absolutely.

What can we not control as investors? The level and longevity of inflation.

What can we control as investors? Our asset allocation.

Why Inflation Matters (Especially to Ultra-High-Net-Worth Families)

Inflation is important because it serves as the performance hurdle that a portfolio must meet for the investor to breakeven and retain purchasing power. That is, if inflation is 5%, a portfolio needs to earn a nominal (not inflation-adjusted) return of 5% to attain a real (inflation-adjusted) return of 0%.

This hurdle rate may be especially important for ultra-high-net-worth families. Inflation data throughout the Covid-19 pandemic indicates that the cost of spending has increased at a faster rate for high income consumption buckets than low income spending buckets.

For this reason, the investment team at Lake Street measures our model portfolio performance against both the market benchmarks and [inflation+ 3%] to measure whether our portfolios maintain purchasing power and yield a spending buffer across all market environments.

What We Can Control: Our Asset Allocation

Multiple studies show that asset allocation is the primary driver of returns, implying that selecting an asset allocation is even more important than selecting individual investment vehicles. In the context of Modern Portfolio Theory, asset allocation is an exercise in building efficient portfolios to maximize return per unit of risk.

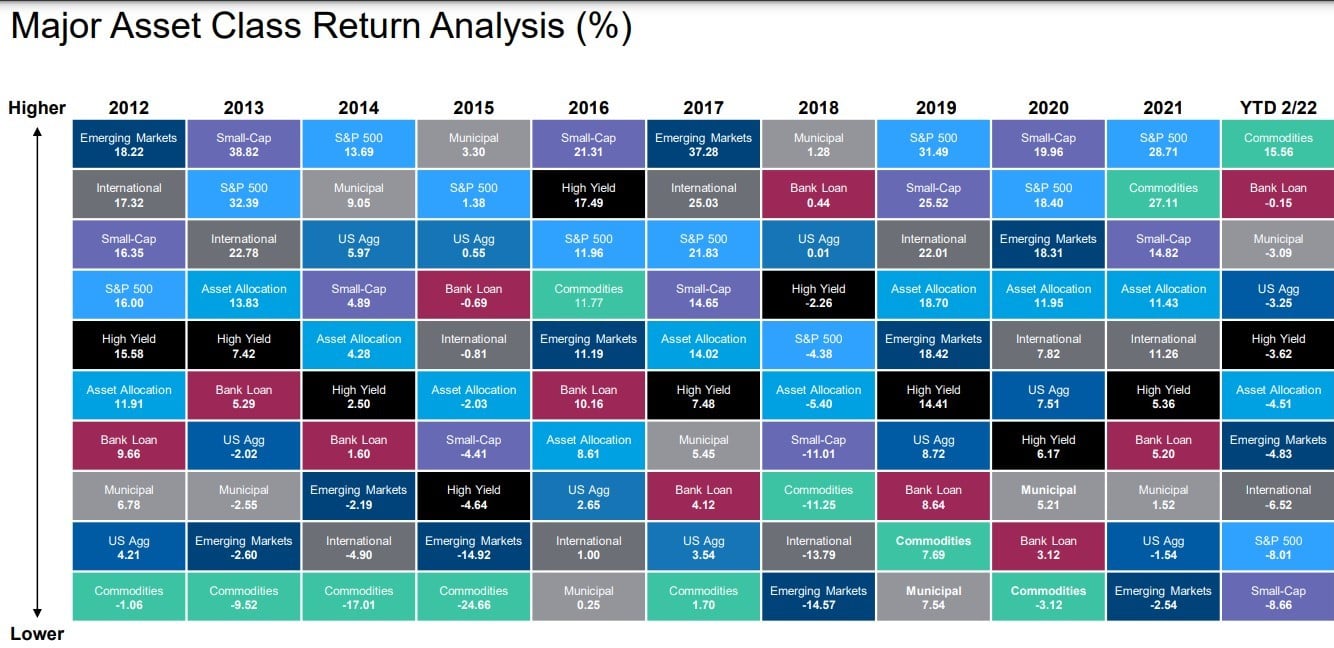

Diversifying among asset classes is paramount to this theory. We diversify because we believe that we, and most investors, cannot predict future economic environments with an adequate level of accuracy. As the below graphic illustrates, the ranking of best and worst performing asset classes may differ in any given year so our portfolios must be positioned to perform in a variety of economic environments.

Source: Eaton Vance, Monthly Market Monitor, March 2022

Inflationary periods may present problems for traditional asset classes, especially fixed income. As mentioned above, the answer to this problem should lie in diversification across other asset classes.

Asset Classes That Perform Well During Inflation

Real Assets

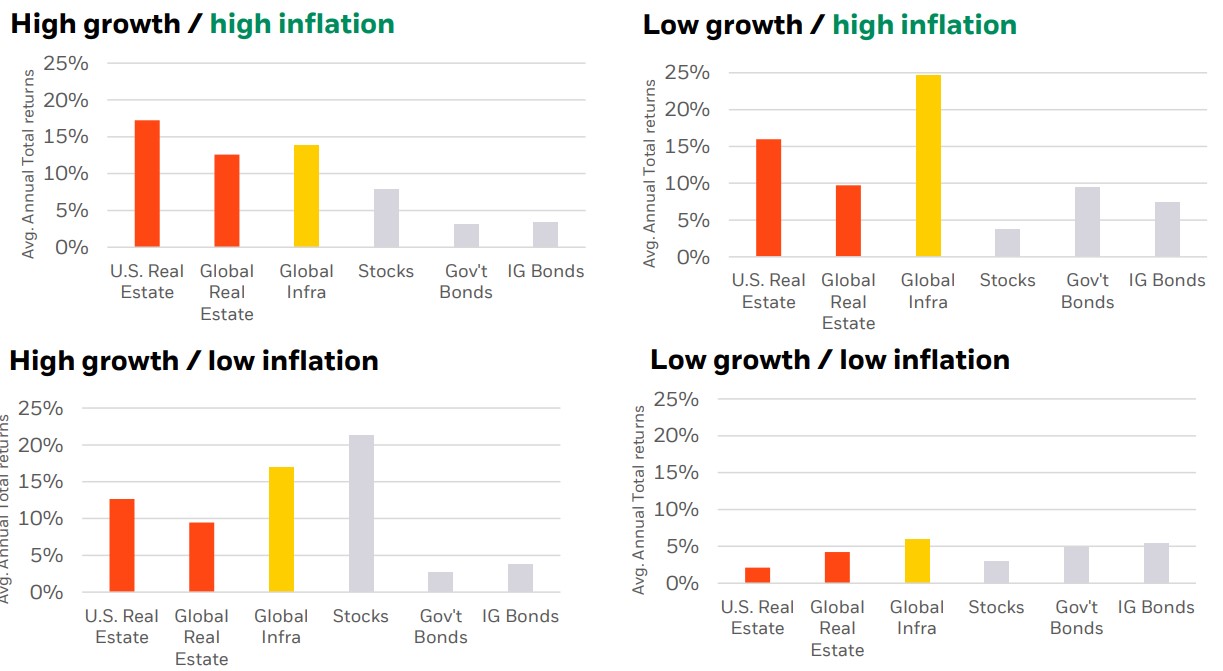

Real assets provide the most direct hedge against inflation, as they are typically equity investments in physical assets that offer cash flows directly or indirectly tied to inflation. Specifically, real estate, infrastructure and commodities are sub-asset classes that benefit the portfolio in inflationary environments:

-

Real Estate

- Real estate offers inflation protection because both property values and rents increase with inflation. Long-term leases, such as those for offices and industrial, often include contractual annual inflation adjustments. Short-term leases, such as those for hotels, self-storage and apartments, update the lease rates frequently to keep up with rising inflation.

-

Infrastructure

- The infrastructure asset class includes sectors such as energy, transportation, water, and data that generate cash flows with revenues tied to inflation. Many of the assets, including the majority of contracted power and utility investments, have direct links to inflation through regulations or contract agreements. Other assets are indirectly tied to inflation and their revenues grow as components of inflation increase, such as energy prices.

-

Commodities

- Commodities have a strong positive correlation to inflation. In fact, the CPI incorporates the prices of some commodities like oil, natural gas and agricultural goods. Since commodities are the raw inputs to many manufactured goods, as we observe those goods rise in price, the underlying commodities also tend to appreciate.

As shown in the below charts, real assets have outperformed stocks and bonds during periods of high inflation, in both strong and weak economic environments.

Source: Black Rock, Inflation & Real Assets

-

Private Credit

- When inflation is high, the Fed generally increases short-term interest rates to curb economic growth. Private credit investments perform well in rising rate environments because most loans are structured using floating-rates (ex: SOFR + 350bps). Thus, floating-rate assets deliver higher yields when rates rise and have minimal interest rate risk. An additional benefit of private credit during inflation is that some segments collateralize loans with hard assets. Inflation will increase the value of the underlying collateral and de-lever the overall investment, reducing the investment’s risk.

It’s important to acknowledge that some private credit investments may use fixed rates instruments which may perform poorly when rates increase.

Asset Classes That May Not Perform Well During Inflation

-

Cash

- In the presence of any inflation, cash will have a negative real return approximately equal to the negative value of the inflation level. That is, if inflation is 5%, last year’s dollar can only buy ~$0.95 of goods today.

-

Bonds

- Fixed rate bond prices and interest rates have an inverse relationship, so as rates rise, the value of an investor’s bond positions will fall, all else equal. This relationship is inherent to the time value of money because present value calculations will apply a higher discount rate to each future coupon and principal payment. This negative correlation can be observed as the market for previously issued bonds become less competitive compared to newly issued, higher yielding bonds. For these reasons, fixed income generally performs poorly in inflationary environments, which tend to correspond with rising interest rates.

- The exception to this negative correlation are TIPS (Treasury Inflation-Protected Securities). TIPS are bond instruments that are indexed to inflation to protect investors from rising inflation. The principal value of TIPS rises as inflation rises, helping protect investors from a decline in purchasing power.

-

Equities

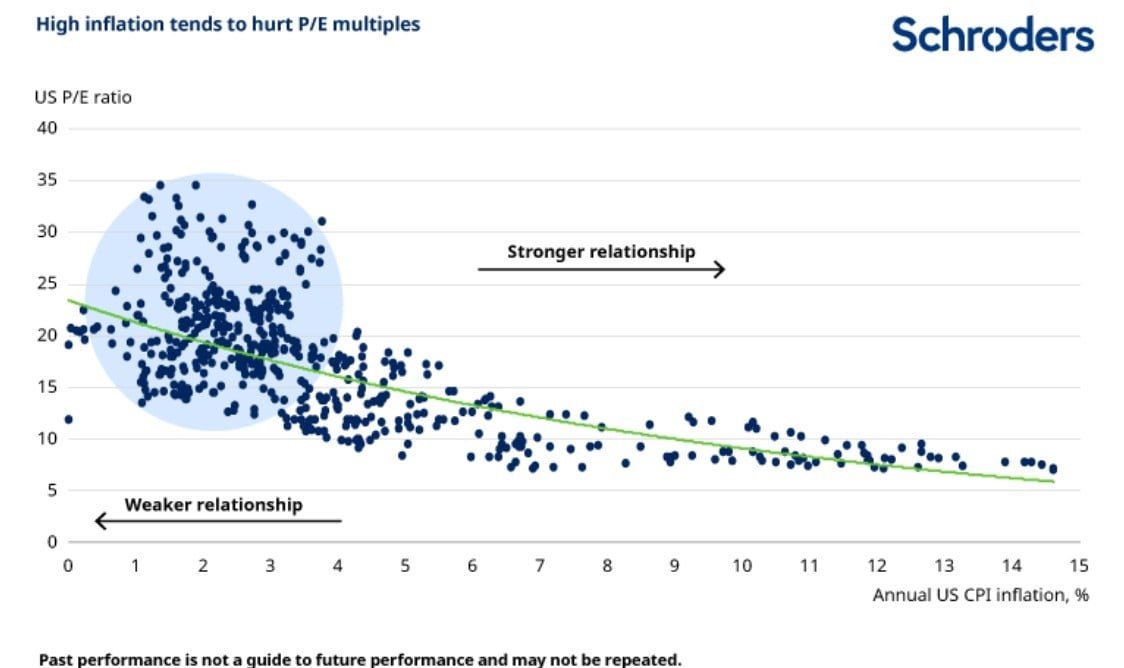

- Rising interest rates increase the cost of debt, which can reduce the net income of indebted companies and dampen equity returns. Additionally, increased interest rates can lead to decreased company valuations (via higher discount rates). The negative correlation between inflation and company valuations (as measured by P/E multiples) is illustrated below:

- Rising interest rates increase the cost of debt, which can reduce the net income of indebted companies and dampen equity returns. Additionally, increased interest rates can lead to decreased company valuations (via higher discount rates). The negative correlation between inflation and company valuations (as measured by P/E multiples) is illustrated below:

Source: Schroders, Which equity sectors can combat higher inflation?

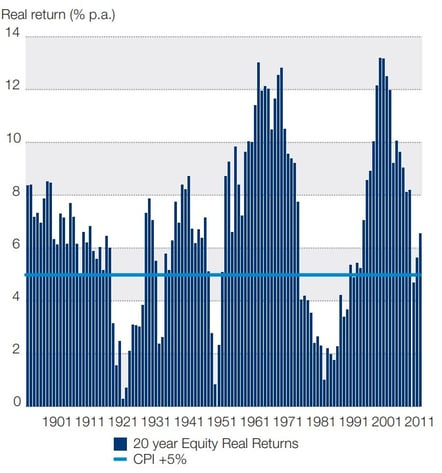

Conventional economic theory suggests that in the long-term, equities can be benefactors in inflationary periods because as prices rise across the economy, companies should be able to pass on the price increases to consumers, increasing the value of the equity stake. This is supported by the below chart which shows that if an investor has held US Equities for at least twenty years then in all instances they have accumulated positive real (inflation-adjusted) returns.

Source: Schroders, Investment Perspectives, What are the inflation beating asset classes?

Source: Schroders, Investment Perspectives, What are the inflation beating asset classes?

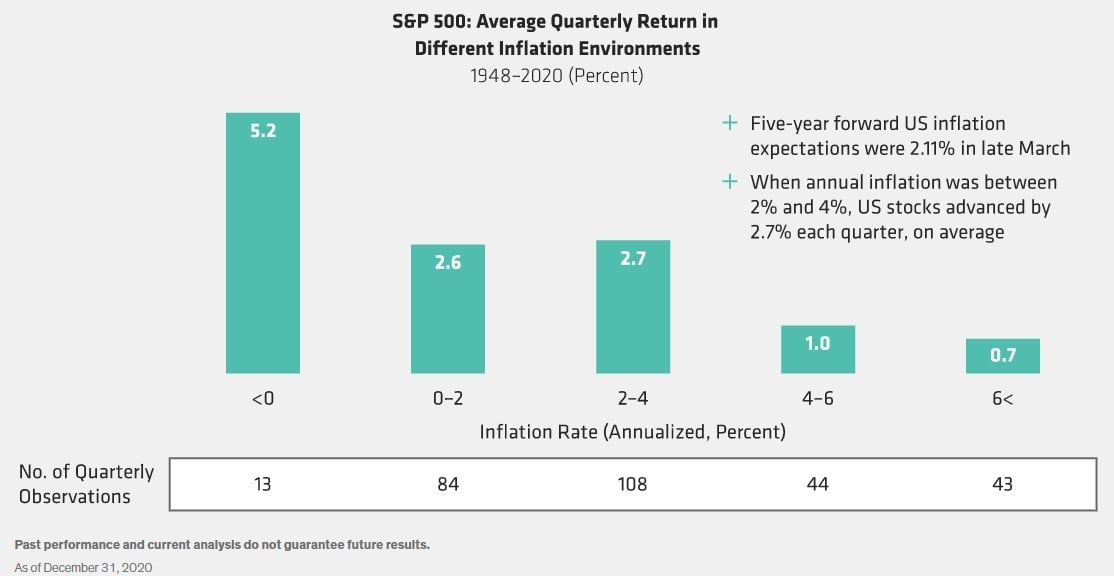

However, over a shorter time horizon, equities generally do not perform as strongly in periods of high inflation, as companies are unable to pass down price increases in real-time and valuations decrease as a function of increased interest (and discount) rates.

Source: AllianceBernstein, Stocks Can Surmount a Return on Inflation

Investment funds that apply financial leverage to scale commitment sizes and enhance returns (as many private equity strategies do), can also have portfolio performance dampened as their cost of borrowing increases. This is on top of the impact of rising interest expenses on operating company financials. Additionally, higher discount rates reducing valuations can limit the exit opportunities and return potential for a private equity funds’ underlying operating companies. As a result, vintage year diversification in private equity allocations is critical to limiting the impact of inflation on exit opportunities.

Closing Thoughts

In the context of Epictetus’ framework, we have determined that inflation matters, and although we cannot control its magnitude or longevity, we can control our portfolio’s asset allocation. Thus, our focus should be on building a diversified portfolio that is positioned to perform in a variety of economic environments, including the current inflationary period.

If you would like to learn more about how to allocate your portfolio, please don’t hesitate to reach out and speak with one of our experienced advisors.

Sources

https://www.wsj.com/articles/us-inflation-consumer-price-index-march-2022-11649725215

https://www.orionphilosophy.com/stoic-blog/stoicism-and-the-dichotomy-of-control#:~:text=What%20is%20the%20Dichotomy%20of,and%20things%20we%20can't.

https://static.vgcontent.info/crp/intl/auw/docs/literature/research/The-global-case-for-strategic-asset-allocation.pdf

https://www.blackrock.com/institutions/en-us/literature/whitepaper/inflation-and-real-assets.pdf

https://www.vaneck.com/us/en/blogs/natural-resources/inflation-is-here-time-to-get-real-with-real-assets/raax-inflation-is-here-do-something-about-it.pdf/

https://validusrm.com/five-ways-inflation-could-impact-private-equity/

https://bspeclub.com/private-equity-tapering-and-inflation/

https://funds.eatonvance.com/monthly-market-monitor.php

https://www.schroders.com/en/sysglobalassets/staticfiles/schroders/sites/americas/canada/documents/investment-perspective-what-are-the-inflation-beating-asset-classes.pdf

https://www.schroders.com/en/insights/economics/which-equity-sectors-can-combat-higher-inflation/