Wealth Transfer Strategies: GRAT vs. IDIT

In this article, we will focus on two strategies used to transfer appreciation outside of one’s taxable estate during life – the Grantor Retained Annuity Trust (more commonly known as, GRAT) and a loan to an Intentionally Defective Irrevocable Trust (IDIT). High-net-worth individuals looking to transfer assets to future generations with lower estate tax consequences should consider either, or both wealth transfer strategies depending on their goals. GRATs are generally better vehicles for short-term transfers to the next generation, leveraging volatile assets. Loans to IDITs are normally more efficient over longer time frames with diversified assets, when trying to pass down wealth to generations beyond their children.

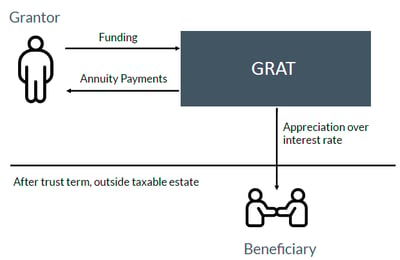

A Grantor Retained Annuity Trust (GRAT) works as follows (see more detail here):

- A grantor creates an irrevocable trust and transfers property into it.

- The grantor receives a fixed payment, or “annuity” for a term of “X” years (two years minimum). The annuity is calculated based on the trust term, the initial funding amount, and the current interest rate, which is equal to 120% of the midterm Applicable Federal Rate (AFR).

- The amount subject to gift taxes is the present value of the interest passing to your beneficiary, or in other words: the original funding amount, less the present value of the annuity payments you will receive.

- A common strategy is for the payout to be such that the gift is equal to effectively zero.

- At the end of the term, any appreciation of the assets beyond the annuity payments made to the grantor goes to a beneficiary specified in the trust document.

- This is usually either a non-GST (Generation Skipping Tax) exempt trust, or to an individual.

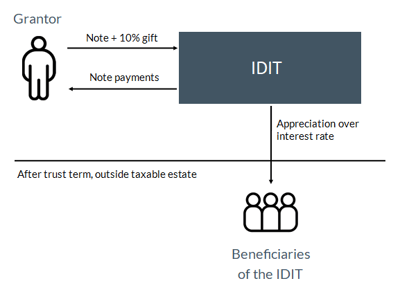

A Loan to an Intentionally Defective Irrevocable Trust (IDIT) works as follows:

- The grantor transfers property to an IDIT in return for a promissory note. Funding the IDIT with a gift of at least 10% equity is generally recommended to substantiate the trust’s ability to purchase assets from the grantor.

- The trust makes ongoing note payments to the grantor per the terms of the promissory note.

- The interest rate used for the note is the Applicable Federal Rate (AFR).

- The short-term rate can be used for loans under 3 years, medium-term for loans 3-9 years, and long-term for loans over 9 years.

- At the end of the note, any appreciation of the assets beyond the note payments made to the grantor is left with the beneficiary, which is usually a GST exempt trust.

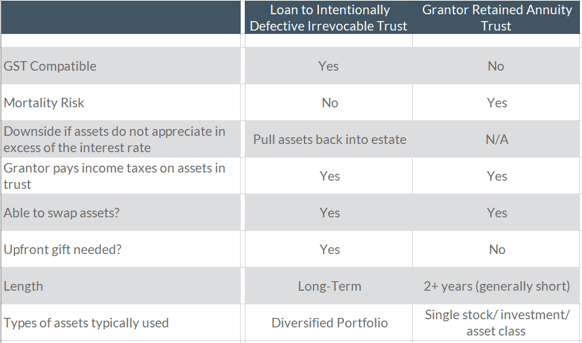

Below is a summary that lists key characteristics of a GRAT and a loan to an IDIT, followed by a table that identifies the benefits and risks/ drawbacks of each.

| Benefits | Risks/ Drawbacks | Strategies | |

| GRAT | Low downside risk. GRAT “failure” just means no remainder value is left after the final annuity payment, the only loss is the legal fees spent setting up the trust. Little or no gift tax consequences. |

Mortality risk. If you die before the trust term ends, the total value of the GRAT is pulled back into your taxable estate (including any appreciation over the remaining annuity payments). Generation Skipping Tax (GST) allocation cannot be effectively applied until the end of the term. |

Make GRATs short to mitigate mortality risk (minimum term is 2 years). Fund with a volatile asset with a lot of upside, given low downside risk. If the GRAT is successful before the term ends (meaning the market value is well above the remaining annuity payments) consider de-risking. This can be accomplished by swapping cash or other less volatile investments (such as bonds) with the GRAT asset up to the point of “locking in” the final annuity payments; this effectively ends the GRAT term early. |

| IDIT | Less mortality risk than a GRAT. The whole value of the IDIT would not be included in the taxable estate if the grantor died during the term, only the amount due on the loan. The grantor can allocate GST tax exemption to the seed capital upfront, so it is a better wealth transfer tool than a GRAT for grandchildren and future generations. |

If the IDIT defaults on the note, all assets (including the 10% gift used to fund the trust upfront) would be pulled back into the grantor’s taxable estate. The IDIT should be funded with 10% of the value of the note, so gift and GST tax may be owed, if above the exemption amount. |

Fund with a diversified basket of assets to decrease volatility, given the greater downside IDITs have compared to GRATs. IDITs should also include income producing assets to cover the loan payments. Similar to GRATs, make sure the grantor has the ability to swap assets in the trust document. This allows flexibility for death-bed planning later in life to swap highly appreciated assets held in the trust for high-basis assets personally held. This would allow the highly appreciated assets to receive a step-up in basis for income tax purposes at the grantor’s death. |

When do these strategies work best?

Low Interest Rates:

The reference interest rate used for both IDITs and GRATs is the Applicable Federal Rate (AFR) . Between February 2020, and May 2020 the midterm AFR dropped over 200%, from 1.75% to 0.58%. This resulted in lower required loan payments for IDITs, and lower required annuity payments for GRATs.

Suppressed Asset Values:

Funding a GRAT or IDIT when asset values are low, compared to their historical value, is a good time to do so because the value of the gift is lower than it would normally be; this allows the appreciation to occur outside of your taxable estate. As we know, markets have bounced back in a big way since early 2020. As of end of day, May 4, 2021, a GRAT or loan to an IDIT funded with $10M of an index fund that tracks the S&P 500 on March 23, 2020 would now be worth approximately $18.6M before accounting for any annuity or note payments. The trust would be on track to transfer $8M+ outside of the taxable estate.

In summary, either a GRAT or a loan to an IDIT can be a great wealth transfer tool for those that have taxable estates. Clients who wish to maximize what they are transferring to non-charitable beneficiaries should consider these wealth transfer strategies in addition to using their lifetime and GST tax exemptions, especially when asset values and interest rates are low.

If proposals such as the “For the 99.5% Act” or “Step Act” were to pass, the benefits of a loan to an IDIT and a GRAT would effectively be eliminated.

For assistance developing wealth transfer strategies for your goals, please don’t hesitate to reach out and speak with one of our experienced advisors.

[i] Monthly rates can be found at: https://apps.irs.gov/app/picklist/list/federalRates.html

[ii] As noted at the beginning of this article, a GRAT uses the Section 7520 Interest rate, which is 120% of the midterm Applicable Federal Rate (AFR). IDITs use the AFR, subject to the duration of the note.