The Uses & Benefits of Private Placement Life Insurance

Private placement life insurance (PPLI) is a special type of life insurance that wealthy families can utilize in optimizing their investment portfolio. To gain a deep understanding of the nuances of PPLI and how this strategy works, I recommend reading our articles, The “Who, What, Where, Why, and How” of Private Placement Life Insurance and Pursuing Minimized Taxes With Private Placement Life Insurance.

The below case study will illustrate how PPLI can be used to accomplish different goals. The specific goals we will review are:

- Save Income Taxes

- Keep Personal Liquidity

- Efficient Wealth Transfer

- Philanthropy

Hypothetical Case Study

In this case study, we have a husband and wife, Mr. and Mrs. Street, who recently sold their business for a net payout of $100m. The couple has two high school aged children to whom they want to pass on the bulk of their assets. They are also philanthropic and would like to leave part of their wealth to several charities.

They would like their investment portfolio to be tax efficient and well diversified across public and private markets. Mr. and Mrs. Street do not plan to work after the sale of their business. Their goal is to draw income from the portfolio to cover their lifestyle and be able to volunteer full-time.

The Street family decided they want to have 40% of their portfolio allocated to alternative investments. They see the benefit of these types of investments, but are worried about the tax drag on the portfolio. So, the couple decides to explore the vehicle of private placement life insurance to hold part of their alternative exposure.

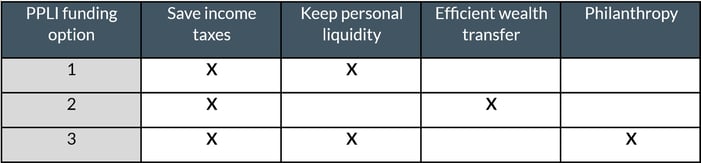

There are three funding options they evaluate for this approach:

-

Fund PPLI within their taxable estate

Knowing alternative investments can produce high taxes from distributions, they fund ~$26m into PPLI and direct an investment manager to focus on alternatives. After meeting the funding and diversification requirements, this part of their portfolio now grows income tax free, reducing a large annual tax burden. With proper funding, they also have the ability to borrow against, or withdraw their original investment should they need additional liquidity. At death, the proceeds will still be subject to estate tax. -

Fund PPLI outside of their estate

The Street family knows the estate and gift tax exclusion is set to reduce in 2026 from $12,920,000 per person, a historical high. Neither Mr. nor Mrs. Street has used any of their lifetime exemptions. They decide to fund an irrevocable trust with $25,840,000 for their two kids. The trustee of the irrevocable trust invests those funds in a PPLI to let the assets grow income tax free for the benefit of the children; this also allows the trust to pass to the children estate tax free at their death. -

Fund PPLI for philanthropy

The Street family knows they want to leave money to charity, but are not ready to give the money away now. They would like some current tax benefits while keeping the funds in their control. They decide to fund $26m to PPLI and make selected charities the beneficiary. They will have access to the funds since they are still inside their estate, but set the beneficiary to be their private foundation. This will allow these funds to grow income tax free and pass estate tax free to the charities.

The table below illustrates which goals are accomplished for the above options:

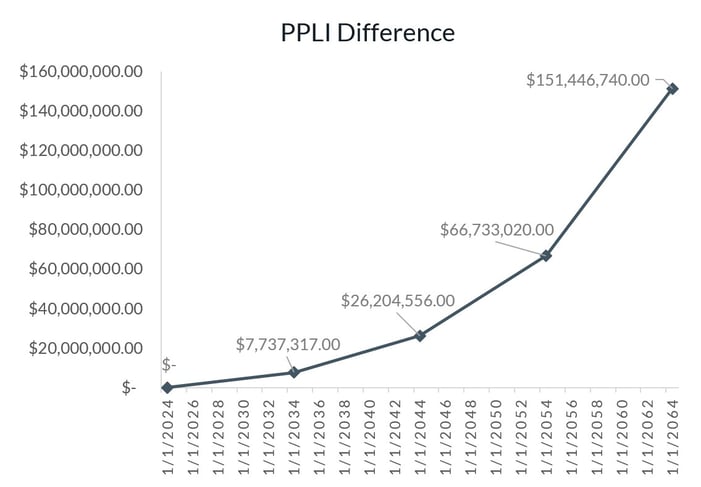

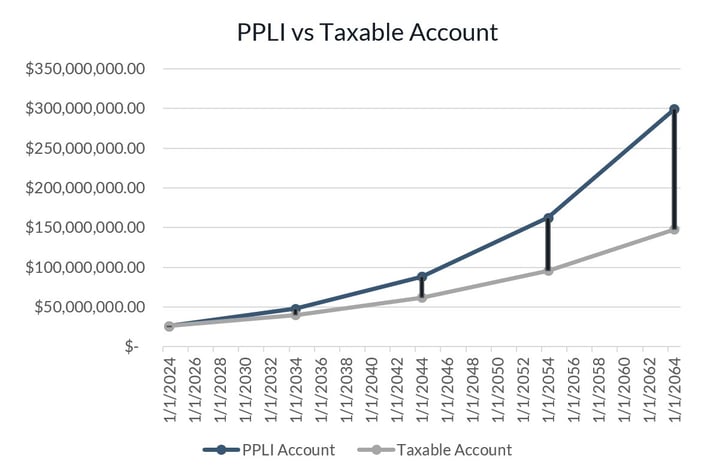

You can see by using private placement life insurance for a part of their portfolio, there can be tremendous advantages with the tax deferral. By not having the tax drag like a taxable account, the PPLI investments are growing more efficiently. The PPLI difference chart shows how over time, the additional growth within PPLI can be significant. The following charts are hypothetical illustrations, actual returns/tax rates may vary.

Conclusion

It is paramount to work with a wealth advisor to consider your entire financial picture and the cost/benefit of each strategy described above before making any decisions.

There is no “one size fits all” when it comes to your hard-earned wealth. At Lake Street Advisors, we work with your family to have a deep understanding of your situation and make recommendations as your fiduciary. If you are interested to learn more about private placement life insurance and discuss strategies relevant for your goals, please don’t hesitate to reach out!

If you enjoyed this article, please subscribe to get our insights delivered straight to your inbox.

IMPORTANT DISCLOSURES AND DISCLAIMERS

This hypothetical case study is provided for illustrative purposes only and does not represent work we’ve done on any client of Lake Street Advisors nor is it intended to be representative of any client experience. Instead it is meant to provide an illustration of Lake Street Advisors approach to planning and tax strategies we believe would be appropriate given the facts and circumstances of the hypothetical case presented.

An individual’s real world experience may vary significantly from the results portrayed in the hypothetical case based on the unique facts and circumstances of each individual. There is no assurance that Lake Street Advisors would be able to achieve similar results as those portrayed in similar situations.

This hypothetical case is not to be interpreted as a testimonial or endorsement of Lake Street Advisors nor the advice or services we provide. We make no representation that any past or present client that may have engaged us to provide similar advice or services to those described in the hypothetical case approves of Lake Street Advisors or its services.

This hypothetical case study is distributed for informational purposes only. The opinions expressed may contain certain forward-looking statements and should not be viewed as recommendations or personal investment advice nor should it be considered an offer to buy or sell specific securities. All information contained in this hypothetical case are obtained from what we believe to be reliable sources.

Past performance is not an indication of future returns. Any legal, tax, and/or insurance related information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal, tax, or insurance advice. We do not provide legal, tax or insurance advice. Always consult an attorney, tax, or insurance professional regarding your specific situation.

Our statements and opinions are subject to change at any time without notice and should only be considered in the context of a diversified portfolio. Individual securities or markets mentioned in this hypothetical case study are not necessarily held in client portfolios and our opinions expressed about them should not be seen as a recommendation to buy, sell or hold any of them.

You may request a copy of the Lake Street Advisors firm Brochure, Form ADV Part 2, which describes the risk factors, strategies, affiliations, services offered, fees charged, and other important disclosures.

The charts above use the following data:

PPLI Portfolio

Annual return after investment management fees: 7%

Annual average PPLI cost .7%

Annual after-cost return 6.3%

Taxable Portfolio

Annual return after investment management fees: 7%

Federal tax 2.56% (40.8% STCG, 23.8% LTCG - assumes 75% of taxes are STCG, 25% LTCG)

Annual after-tax return: 4.44%